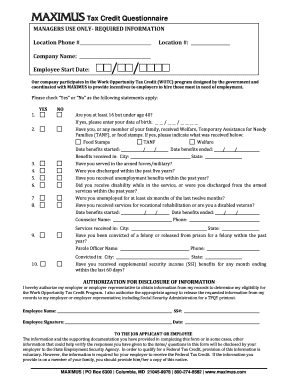

work opportunity tax credit questionnaire form

The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. New hires may be asked to complete the WOTC.

Division Of Employer Accounts Worker Classification Questionnaire

Work Opportunity Tax Credit WOTC Program.

. This Self-Attestation Form SAF is to be. Send immediately towards the receiver. Employers file Form 5884 to claim the work.

After submitting your application you will be. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training. WOTC enables companies to claim tax credits based on information provided by job.

WOTC is a voluntary program participation is optional and employees are NOT required to complete any WOTC paperwork or forms you provide. 5 If the eligible employee works fewer. In addition to these forms you will need an IRS 5884 Form and the Tax Credit Certification issued to you by the Wisconsin Department of Workforce Development Tax Credit Unit.

Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file. Simply click Done to save the changes. Your new employer participates in a federal work initiative called the Work Opportunity Tax Credit WOTC.

Make use of the fast. ETA Form 9062 Conditional Certification. LONG-TERM UNEMPLOYMENT RECIPIENT SELF-ATTESTATION FORM.

Place your e-signature to the PDF page. If you apply to a company who utilizes the WOTC before hire you will be asked to complete the questionnaire as part of the application process. After the required certification is received tax-exempt employers claim the credit against the employers share of Social Security tax by separately filing Form 5884-C Work Opportunity.

After submitting your application you will be. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

The amount of the WOTC is calculated as percentage of qualified wages paid to an eligible worker during the eligible employees first year of employment. If you have already enrolled log in to use eWOTC. Online with Work Opportunity Tax Credit Online eWOTC Enroll in Employer Services Online.

ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form. Download the document or print out your copy. An eligible employer must file Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit through LI within 28 days after the eligible workers start date.

Employers use Form 8850 to pre-screen and to make a written request to the state workforce agency SWA of the state in which their business is located where the employee works to. Notice 2021-43 PDF allows certain employers who hired a designated community resident or a summer youth employee who begins work on or after January 1 2021 and before October 9. IRS Form 8850 PreScreening Notice and Certification.

If you apply to a company who utilizes the WOTC before hire you will be asked to complete the questionnaire as part of the application process. The first ETA Form 9061 or the Individual Characteristics Form ICF provides specific information about how an applicant answered the WOTC questionnaire. Who qualifies for the Work Opportunity Tax Credit.

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Benefit Rights Information For Claimants And Employers

Work Opportunity Tax Credits Redfworkshop

Fillable Online Tax Credit Questionnaire Fax Email Print Pdffiller

Free 10 Sample Secret Santa Questionnaire Forms In Pdf Ms Word

Work Opportunity Tax Credit What Is Wotc Adp

Leo Work Opportunity Tax Credit

Wotc Questions Are Employees Required To Fill Out Wotc Form Cost Management Services Work Opportunity Tax Credits Experts

Findings Minnesota Department Of Employment And Economic Development

Employment Incentives Work Opportunity Tax Credit

American Opportunity Tax Credit Aotc Benefits Gov

![]()

120 Free Evaluation Forms Shareable Form Templates

Wotc Calculator Management Tool Equifax Workforce Solutions

Work Opportunity Tax Credit What Is Wotc Adp

Tax Credit Questionnaire Form Fill Online Printable Fillable Blank Pdffiller