owner's draw in quickbooks self employed

Therefore your owners draw has no tax consequences and does not need to be entered. Before you can pay an owners draw you need to create an Owners Equity account first.

Setup A Draw From Quickbooks Self Employed

If QuickBooks displays the Payments to Deposit window click to select the payment and the investment check that you want to deposit and then click the OK button.

. Step 4 Click the Account field drop-down menu in the Expenses tab. Select Petty Cash or Owners Draw depending on the method you want to use to track funds. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

For accounting purposes the draw is taken as a negative from their business ownership account called owners equity. After that click on the Equity Account function now fill the owners draw in the Account Name click OK. Click the Banking tab in the main menu bar at the top of the screen.

Step 4 Click the Account field drop-down menu in the Expenses tab. This is not necessarily true for more complicated business entities. Ad QuickBooks Online Official Site.

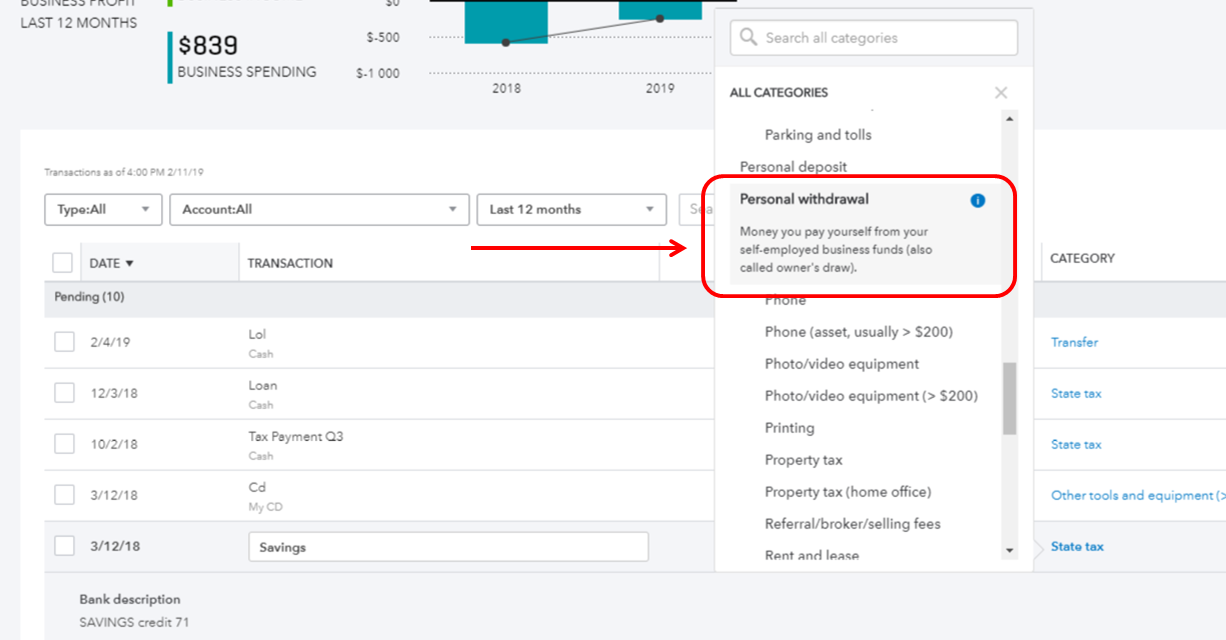

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Owners Draw on Self Employed QB. Also known as the owners draw the draw method is when the sole proprietor or partner in a partnership takes company money for personal use.

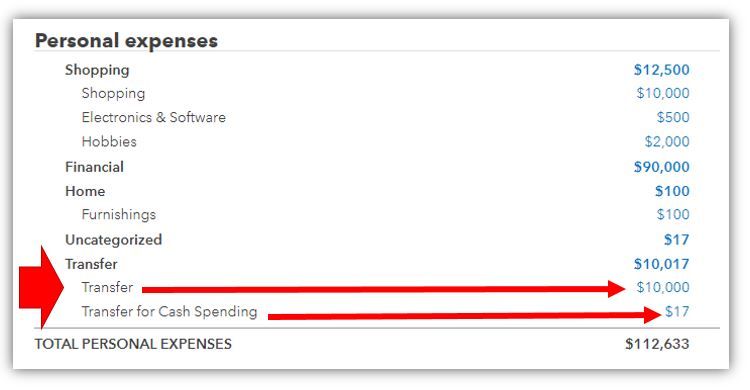

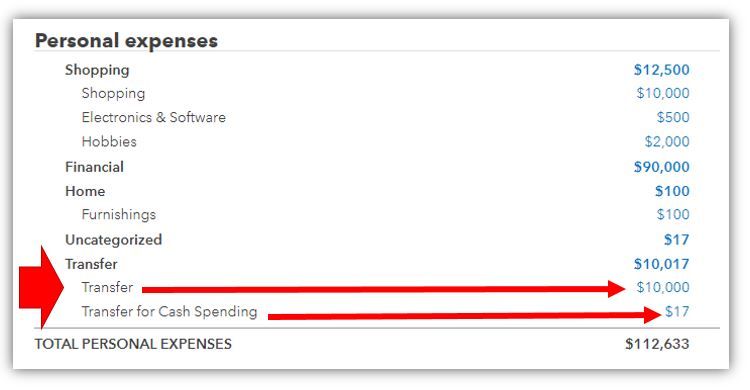

An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the Estimated Quarterly Self-Employment Taxes you will owe to the IRS. If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep.

There are few option mentioned-below which has to be chosen. 1 Best-Selling Tax Prep Software. Click on Chart of Accounts and hit on the Add tab.

If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the money in the business. Follow these steps to set up and pay the owner. The Chart of Accounts can be helpful t to record the owners draw in QuickBooks.

Help with Owner Salary or Draw Posting in QuickBooks Online. You will setup an EFTPS Electronic Federal Tax. Alternatively click the Cancel button.

Select Make Deposits from the drop-down menu. In some cases self-employed business owners might have an option to take either a draw or a salary depending on the tax circumstances. Business owners generally take draws by writing a check to themselves from their business bank accounts.

Youre allowed to withdraw from your share of the businesss value through an owners draw. Create an Owners Equity account. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

Type the owners name if you want to record the withdrawal in the Owners Draw account. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop.

Tutorial 2021 Quickbooks Self Employed Updated Youtube

Solved Owner S Draw On Self Employed Qb

How To Track Mileage Quickbooks Self Employed Youtube

M Green Company Llp A Professional Tax And Accounting Firm In Tulare California Blog

Accept Paypal Payments Quickbooks Desktop Quickbooks Quickbooks Online Paypal

Quickbooks Enterprise 5 Features For Receipt Management Quickbooks Management Enterprise

Quickbooks Self Employed Complete Tutorial Youtube

How To Use The Employee Self Service Portal In Quickbooks Payroll Youtube

Why You Need Quickbooks Online For Your Business Brahmin Solutions

Solved Owner S Draw On Self Employed Qb

.png)

Quickbooks Online Tag Tricks You Need To Know Berrydunn

How Much Does An Employee Cost Infographic Patriot Software Entrepreneur Business Plan Accounting Education Budget Help

Bundle And Save With Daily Skill Building Vocabulary Spelling

Norpak Corparation Junior Size Logan Wrap 8 X 10 75 Inch 500 Sheets Per Box Review Wax Paper Dry Wax Baking Cups

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

How To Create Send Track Invoices W Quickbooks Self Employed On The Web Youtube

Solved Owner Has Been Incorrectly Taking Owners Draw Instead Of Using Payroll Owner Is Taxed As An S Corp

How Can I Run An Owners Draw Report To See The Total Drawn

How To Choose The Best Legal Structure For Your Startup Business Infographic Business Finance Business Advice